Fed Madness: $50B MBS Pump in March Despite 'End of QE' & More Sham 'Audits' by KPMG

If the Fed blatantly lies on the small stuff, how much do they lie on the big stuff?

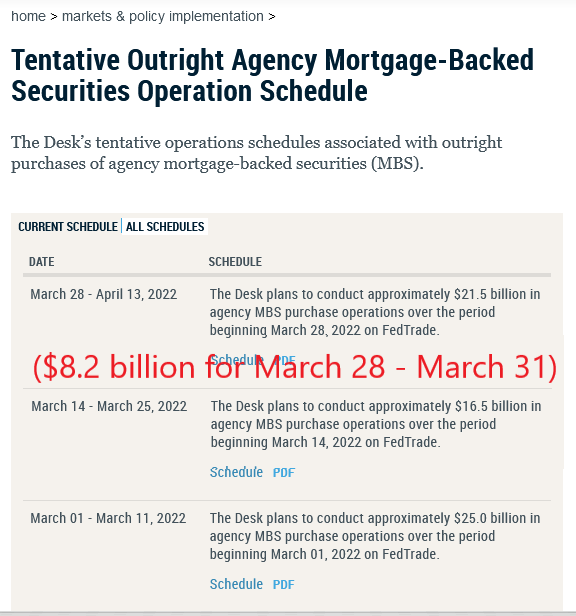

On Friday afternoon, the New York Fed confirmed what we expected. They plan to purchase another $8.2 Billion in residential mortgage-backed securities (MBS) from March 28-31. That will bring their total for the month of March to roughly $50 Billion MBS purchases. That’s at least $10 Billion more than seems possible if the Fed really ended QE like they said they would.

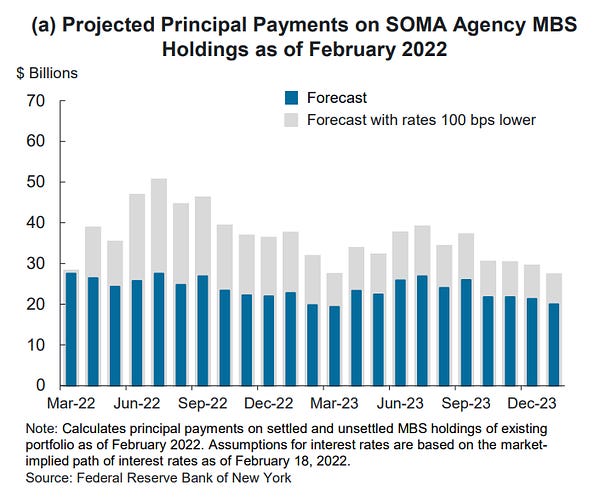

As we explained last week, on March 2nd, the NY Fed’s own Vice President Lorie Logan provided a chart estimating the Fed’s principal payments for its massive $2.7+ TRILLION holdings of MBS it bought in just 2 years. The NY Fed’s estimate clearly shows less than $30BN for March. The Fed’s final “fresh” QE purchase of $10BN MBS took place between Feb. 15 to March 15. That means the Fed should have bought at most $40BN MBS for March (even if the last QE purchases were entirely backloaded). So where’d the extra $10+ Billon come from, Ms. Logan?

Some Fed apologists have criticized us (and others crying foul like Northman Trader and Apparently Exempt) as “conspiracy theorists” and suggest we’re just too stupid to understand the nuances of MBS settlements. Nonsense. We’re not just talking about the insanely ridiculous fact that the Fed’s $9 TRILLION balance sheet is still INCREASING after QE purchases are supposedly over and inflation is 400% over target. We’re looking at the Fed’s own principal payment estimate and comparing it to their own stated purchases for the month. And unlike the Fed and its minions, the math don’t lie.

No one has even tried to justify the questionable $10BN+ in excess Fed MBS purchases for March with any supporting detail. It should be very simply for one or two of the thousands of employees at the Fed to explain and prove their work down to the CUSIP. Instead, we’re just supposed to trust the Fed and its sole agent BlackRock are properly “reinvesting,” “rebalancing” or “rolling over” MBS purchases. Sorry, but that’s just batshit crazy — especially after the Fed’s massive insider trading scandal, their incessant “transitory” inflation lies, not to mention the fact that BlackRock’s no-bid contracts to run QE are an ethical conflicts shitshow.

$10 billion may seem like a minor discrepancy (at least to the Fed after blowing trillions of our dollars), but it’s massively important. Chair Powell swore the Fed was ending its QE program, i.e. OVER not just TAPERED. If the Fed is lying about this, how can we trust they’re not fudging the numbers on the rest of their “emergency” actions and astronomical $4.5+ TRILLION QE purchases they ran in just 2 years?

Everyone should go see for themselves the mind-boggling amounts of RESIDENTIAL MBS the Fed/BlackRock has been buying month after month with virtually zero accountability, oversight or pushback: https://www.newyorkfed.org/markets/ambs/ambs_schedule

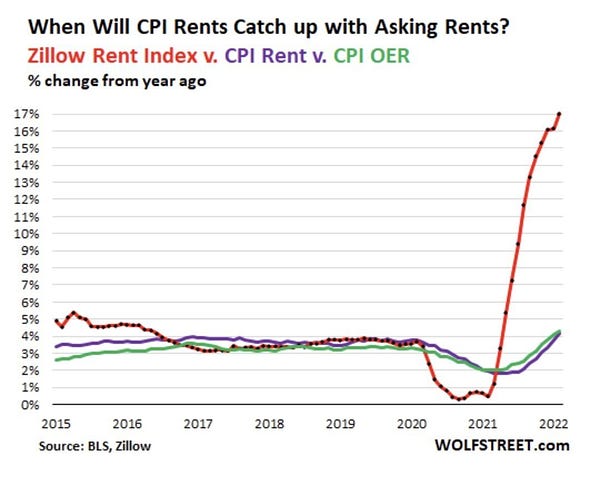

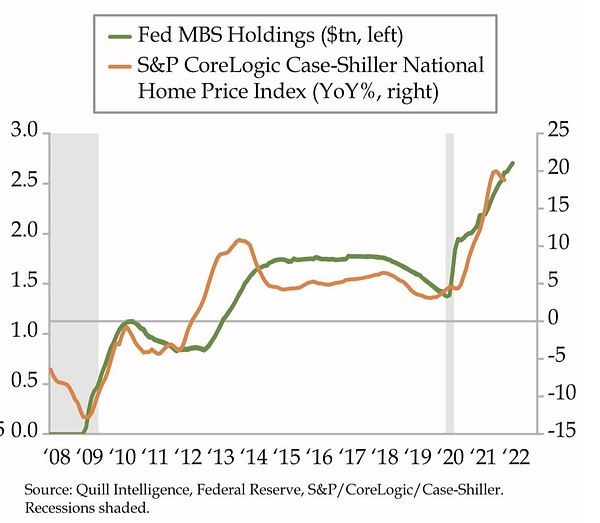

The Fed’s out-of-control QE program — even if solely reinvestments or otherwise — must be HALTED immediately before the Fed plunges our country deep into a national homeless crisis. At Acting Chair Powell’s confirmation hearing in January, U.S. Senator Thom Tillis — an important member of the Senate Banking Committee that is supposed to oversee the Fed — literally thought the Fed’s was already shrinking it insane $9 Trillion balance sheet. That would certainly make sense given that the Fed is currently blowing its inflation target by about 400% (~8% CPI versus 2% CPI target) with housing inflation that’s far, far worse.

Sen. Tillis is no dummy. He was a partner at PwC, one of the Big 4 accounting firms. He has direct access to Chair Powell to discuss these issues. If someone with Senator Tillis’ experience doesn’t understand what the fuck the Fed is doing here, then it’s a big fucking problem (pardon our French, but the Fed is destroying peoples’ lives!).

Fed Has No Credibility or Accountability, Sham Audits Don’t Help

The Federal Reserve’s website states: “Although parts of the Federal Reserve System share some characteristics with private-sector entities, the Federal Reserve was established to serve the public interest.” What they don’t want you to know is that the New York Fed — which implements the Fed’s monetary policy through QE, Repos, Reverse Repos, central bank currency swaps, and all sorts of other murky market manipulation — is literally owned and controlled by 5 of the largest megabanks on Wall Street: JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley, and BNY Mellon. As Wall Street on Parade also notes, the other three Wall Street megabanks are Bank of America, shareowner of the Richmond Fed; Wells Fargo, shareowner of the San Francisco Fed; and State Street, shareowner of the Boston Fed. You can learn more about all this here.

We cannot stress this fact enough - while the Fed Board in DC is a federal agency that allegedly acts “independently” for the “public interest” in setting national monetary policy, the regional banks that implement Fed policy are owned and controlled by Wall Street. It’s absolutely essential that every American knows and understand this. We all need to tell Congress to take action on reforms like shutting down every Fed Regional Bank, just as Senator Toomey recently discussed with Senate Banking.

But what happens when American monetary policy in DC is controlled by a former Wall Street lawyer who never studied economics before working as a private equity “vulture” at Carlyle Group? It’s simple - the Fed and Wall Street go absolutely wild!

Under Chair Powell, the Fed has taken and continues to take massively controversial moves, including:

More than doubling its balance sheet to $9 TRILLION in less than 2 years, buying not just US Treasuries, but also residential mortgage-backed securities, municipal bonds, and even $AAPL corporate bonds!

Pumping $20 TRILLION in cumulative repo loan bailouts to Wall Street trading houses, including Nomura Securities International ($3.7 trillion); JP Morgan Securities ($2.59 trillion); Goldman Sachs ($1.67 trillion); Barclays Capital ($1.48 trillion); Citigroup Global Markets ($1.43 trillion); and Deutsche Bank Securities ($1.39 trillion), and recently creating a Standing Repo Facility for Wall Street & foreign central banks(!) to try to normalize its bailouts.

Creating central bank currency “liquidity” swaps for foreign countries that have been identified both as currency manipulator (Swiss National Bank) and on the Treasury watch list (Bank of Japan) (Note: Swiss National Bank is purportedly no longer a currency manipulator, but used reserves to purchase more than $160 BILLION in US stocks, especially big tech stocks. It nearly doubled its US stock holdings over the past 2 years after repeated private calls between Jerome Powell and the Swiss National Bank President! (See Powell’s calendars here, here & here)

In March 2020, the Fed even slashed US bank reserve requirements to ZERO — and still hasn’t reversed that decision despite allowing Wall Street banks to engage in massive stock buybacks and lavish their executives with the biggest bonuses in history!

Other than Powell and his cronies, God only knows the full extent of reckless and corrupt action the Fed is taking behind the scenes for the “public interest,” i.e. for the benefit of Wall Street. The Fed likes to tout how it makes its “independently audited financial statements” public, so everything must be on the up and up, right? Wrong.

On March 21st, the Fed released its allegedly “audited” financial statements for 2021. Shocker, the Fed’s auditor didn’t uncover material deficiencies. Over the past few years, the Fed has engaged KPMG. If you want to understand why KPMG’s audits don’t exactly inspire any confidence, get a load of this:

“In January 2019, the PCAOB [Public Company Accounting Oversight Board] released its inspection report on KPMG for 2017. The inspection found that KPMG botched 26 of 52 audits inspectors examined.

Compared to its U.S. peers, KPMG had the highest percentage of botched audits in its most recent annual inspection report and the highest number of botched audits for all inspection years combined.

Yet KPMG ranked lowest in PCAOB fines. Its grand total: Zero.”

See Project on Government Oversight’s excellent exposé on the woefully inadequate integrity and oversight of major accounting firms, especially Fed auditor KPMG (https://www.pogo.org/investigation/2019/09/how-an-agency-youve-never-heard-of-is-leaving-the-economy-at-risk/).

The only time the Federal Reserve received a remotely credible audit was by the Government Accountability Office shortly after the Global Financial Crisis. Congress didn’t even allow GAO full access to all Fed programs, but what GAO did uncover is fucking horrifying. Without clear authority or public disclosure, the Fed shelled out a cumulative $29 TRILLION in bailouts to Wall Street in connection with the GFC.

We shudder to think what the Fed’s final tally will be under the guise of “pandemic” response. Powell himself admitted on “60 Minutes” that the Fed “flooded the system” with digitally-printed dollars. But who knows if and when we’ll ever find out. While some in Congress are starting to get fed up, we clearly need something like the Federal Reserve Transparency Act, which has repeatedly died in the Senate.

Another problem this time is that corporate media has all been bought and is controlled by Wall Street. Blackstone acquired the majority stake of Reuters over a year ago. BlackRock owns major stakes in CBS, NBC, Fox and CNN. These are the very entities buying up every affordable house they can find on the US market. The Fed monetary policy of buying trillions in RESIDENTIAL MBS and giving Wall Street effectively zero percent loans for cash is exactly what helps them do it.

It’s time for us regular Americans to wake up. It’s time to get passionate. This shit really matters. They want to make it sound complicated. But the crux of it is simple: intentional, government-assisted theft from the American middle and working class by the Fed and their cronies on Wall Street. It won’t stop until we stand together and say enough is enough.

Let’s Fucking Go!

#OccupyTheFed #AuditTheFed #EndTheFed

Thanks for the article. Can't wait for the inevitable 'who could have seen this coming' post crash