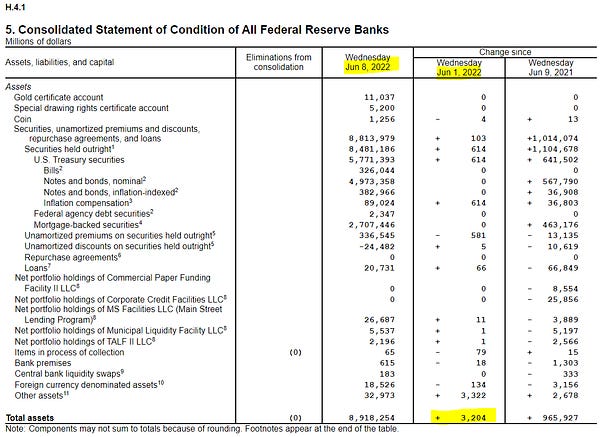

FED Purchases $42.3BN USTs and MBS from June 1st-9th Despite 8.6% CPI, 20%+ Housing Inflation

Just $18.4BN left to "reinvest" with 19 more Treasury auctions scheduled in June; and FED already bought billions more MBS than estimates for entire month of June

America is gripped by an inflation crisis intentionally caused in main part by the FED. The FED (and the politicians who chose to reinstall its corrupt and feckless leaders) claim the FED has the tools to handle it. That’s nice, but to date the FED has effectively done nothing — it has raised rates less than 1% and has failed to meaningfully shrink its monstrous balance sheet despite proclaiming it would start “Quantitative Tightening” or “QT” on June 1st.

CPI “inflation” is more than 400% over the supposed 2% target (even CPE is >300% over target). So why is the FED lollygagging? Well, the Federal Reserve Board is corrupted and has been for many years. Unlike the regional Fed Banks — which are literally owned and controlled by Wall Street megabanks — the Fed Board in DC is supposed to operate in the public interest. But now the unelected, “independent” federal agency is controlled by Wall Street through Fed Chair Jerome H. Powell, a.k.a BlackRock Jay or private equity’s own inside “man in Washington.”

Who does inflation benefit? Wall Street and the 1%. And centimillionaire Fed Chair Powell has $10s of millions personally invested in Wall Street’s proprietary securities products, especially Larry Fink’s shadow banking behemoth, BlackRock.

Who does inflation hurt? Everyone else. And with inflation spiraling out of control and three consecutive scorching hot CPI prints well above 8%, what did BlackRock Jay and the FED do? Well, the FED (with the help of no-bid contractor BlackRock) proceeded to buy $42.3 BILLION in US Treasurys and Mortgage-Backed Securities in just the first 9 days of June!

Why does it matter? Because even more than slashing rates for banks to zero, the FED’s batshit crazy decision to pump its balance sheet to roughly $9 TRILLION has sparked the worst inflation in modern American history. The past few FOMC meetings, the FED made grandiose platitudes about inflation being unacceptably high and pronouncements about finally shrinking its monstrous balance sheet. Well, we’ll believe it when we see it — and we haven’t seen it yet.

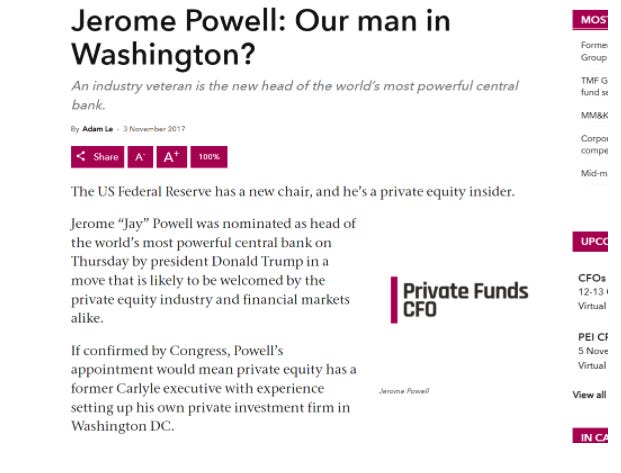

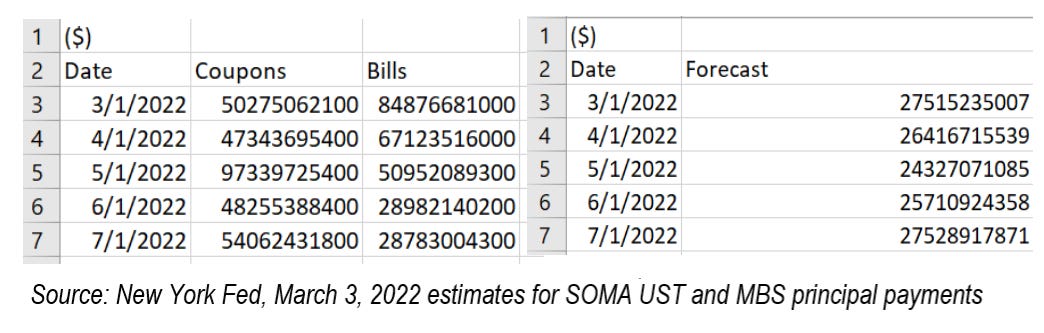

First, let’s take US Treasurys. In June, the FED claimed it would institute a $30 Billion cap on reinvesting the principal payments it receives for its massive UST stash. Just three months ago, the FED estimated UST principal payments for June would total $77.23 Billion. After applying the $30BN cap, that comes to $47.23 Billion to “reinvest” for the entire month of June.

And the FED has been very busy “reinvesting” this month. In just the first 9 days of June, the FED has purchased $28.8 Billion in USTs, leaving just $18.4 Billion left for the rest of the month. The problem? The Treasury plans to hold 19 more auctions in June! Do you think the FED is really going to limit purchases to less than $1BN on average per auction? If so, hold on to your hats!

Things get even funkier when it comes to MBS. The FED’s own estimate for principal payments for June was $25.7 Billion (Note: the FED made this estimate when mortgage rates were lower and, thus, actual prepayment amounts should be significantly less than $25.7BN for June given the recent rate increases). But let’s be generous. The FED announced a measly $17.5 Billion cap for MBS, so that would leave the FED at most $8.2 Billion to “reinvest” in MBS.

Guess what? The FED has already bought more than $13.5 Billion MBS in the first nine days of June. These illicit, unjustified excess MBS purchases are especially unconscionable if you know the real inflation rates for housing.

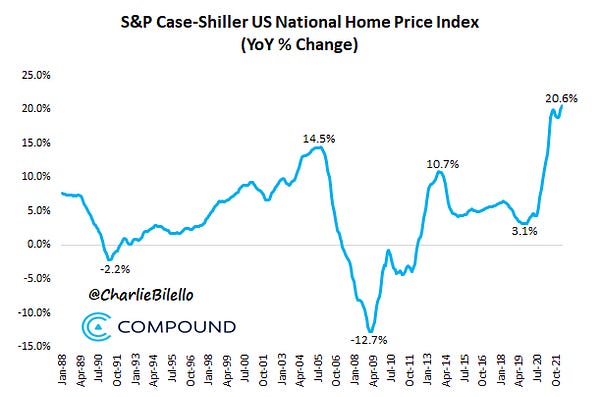

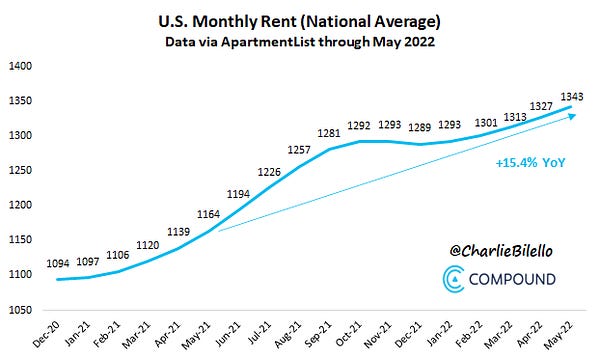

In the May CPI release, the Bureau for Labor Statistics “economists” still estimate shelter inflation at a “measly” 5.5% year over year. But real inflation rates for rent and houses are astronomical and have been for more than a year. Charlie Bilello, CEO of Compound Capital Advisors, always sums it up well:

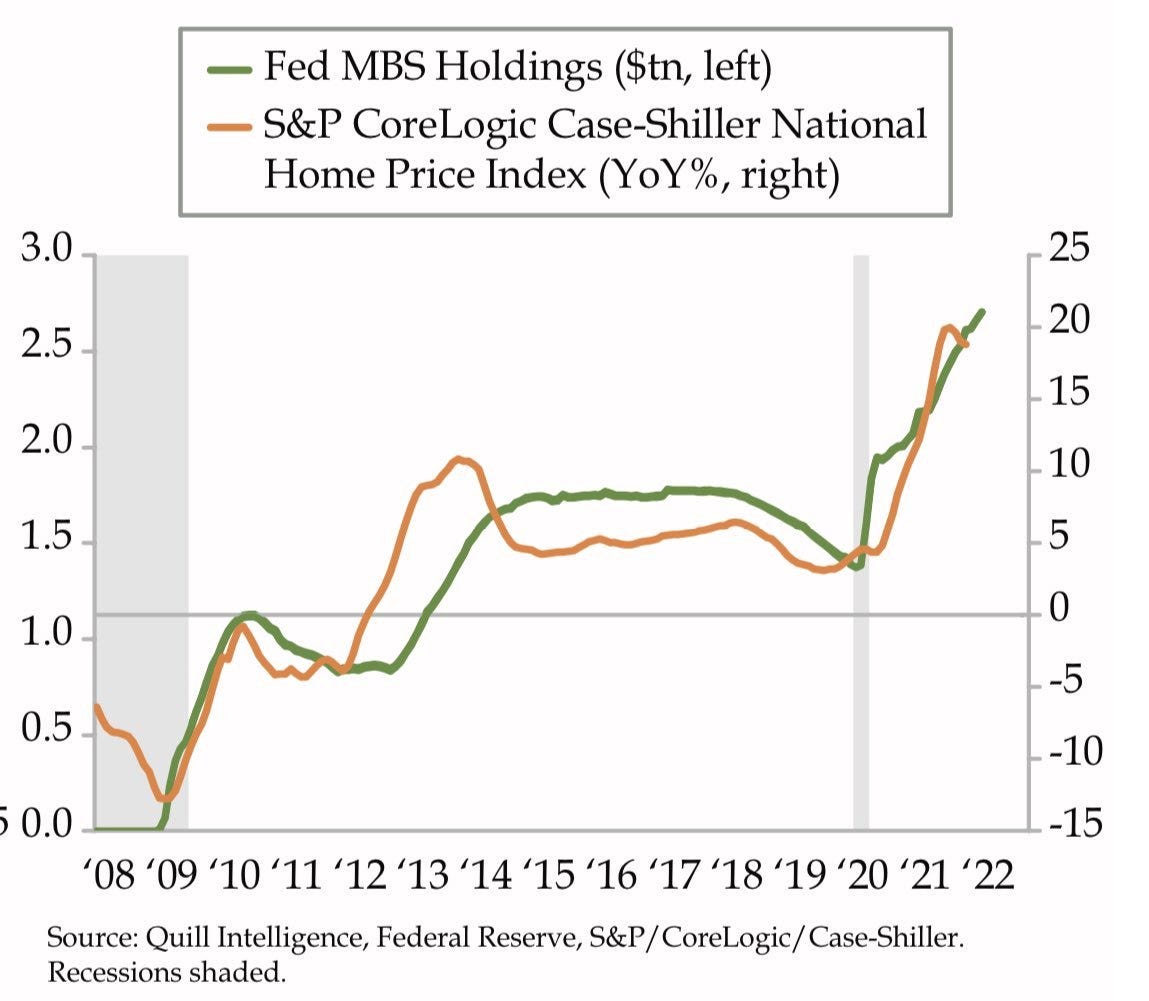

Perhaps more so than any other category, there is an exploding housing inflation crisis in America. Home prices are up more than 20% year over year for those who can still afford them. Rents are up more than 15% year over year for everyone else, from college kids to grannies on a fixed income. Soaring housing inflation is most directly caused by the FED’s own radical purchase of $2.7 TRILLION in residential mortgage-backed securities. Nobody ever voted on this. No law was passed expressly authorizing the FED to buy MBS at all, much less $2.7 Trillion of it.

Indeed, there are strong arguments that the FED’s MBS purchases are entirely illegal because there is “no express provision in the Federal Reserve Act for the Federal Reserve to use its open market authority to purchase private sector promissory notes … Conversely, the plain meaning of Section 14 reveals that the Federal Reserve may not purchase private assets because they lack the requisite ‘full guarantee’ element required by the Federal Reserve Act.” Chad Emerson, More Illegal Actions of the Federal Reserve: How the Federal Reserve Acted Outside the Scope of Its Legal Authority in Purchasing Securities from Fannie Mae and Freddie Mac, 29 NO. 10 BANKING & FIN. SERVICES POL’Y REP. 11 (Oct. 2010).

So why did Jay Powell and the FED take us down this treacherous path of inflating a bigger housing bubble than the GFC? And destroying the American dream for generations of middle and working class Americans? And destabilizing the bedrock of our neighborhoods, our towns, our cities and our society as a whole?

Simple: BlackRock and other Wall Street firms have been frontrunning the FED purchases and are now balls deep into residential real estate. And they don’t want to be left holding the bag when the FED-fueled bubble blows. They want the FED to just keep blowing it and damn the consequences for the rest of America. Or at least give them a long enough exit ramp to dump their bags on everyone else before the bubble violently explodes.

We don’t relish publicly exposing credibility-destroying inconsistencies, deceit and corruption of the federal government. Trust us, there are plenty of other things we’d rather be doing. We sincerely wish that when people like Jay Powell and Gary Gensler decided to go into the “public service” and work with the “eagle on their shoulder” - they actually meant it - instead of just looking to line their own pockets and enrich their rich cronies/real bosses on Wall Street.

We also wish that some of America’s traditional checks and balances were still remotely recognizable - like say a free press that held power accountable. Corporate media is now entirely controlled by Wall Street shareholders. Social media like Twitter too! (Hence the indefinite “suspension” of @RudyHavenstein over a single unspecified DMCA complaint and threats to @NorthmanTrader over the same).

So where does that leave us? A small but growing contingent of citizen journalists, independent investigators, public informers spreading the word. People who are willing to ask questions, think for themselves and take the time to investigate the bullshit we’re being peddled. People who have figured out the game and are willing to expose it, even if it’s not to their own advantage, because they see the devastating effects on their fellow Americans.

The powers that be call us “activists” or “conspiracy theorists” because we won’t shill Wall Street-controlled government and media narratives? Fuck that. We’ll keep giving you the facts and let you decide.

#OccupyTheFed

*Everything Occupy The Fed writes is for informational purposes only and represents the writers’ opinions based on publicly available information. Nothing we write is ever intended as, nor should it be relied upon as, investment advice. The best investment advice in this Golden Age of Fraud seems to be based on inside information from government officials, and we would never try to compete with that.

“The median asking rent in the U.S. during May was $1,995, a 26% increase from last year, Dwellsy said.

Median rent accounted for more than a third of pre-tax median income, at 36.4%”

So contrary to what some people might think, your posts are careful not to overstate anything.

Now we are in JPOW’s horrible half hour. Breaking from precedent, he has a press conference after every Fed meeting. But not right away after the announcement. He waits a half hour. What is he doing during that half hour? Very unlikely that any significant news on inflation, the economy or even world affairs will occur in that half hour. What will happen for sure is the stock market will react to the Fed announcement. Does JPOW see this? You bet. A repetitive pattern is that the market goes down. Then JPOW stands up. And says something that causes the stock market to rebound. Something to reassure the market that unprecedented loose monetary policy (and unprecedentedly inflationary monetary policy) will continue for some time. And the market rebounds.