Fedcoin is a shitcoin - and the Fed uses lies about inflation like CPI and 'transitory' to shill it

The Fed intentionally lies to manipulate long-term inflation expectations so it can funnel obscene levels of wealth to Wall Street by debasing the dollar

One of the first questions any half-decent cryptocurrency investor asks about a new project is simple: what’s the maximum supply? Bitcoin is a trustless, decentralized system in which mining (i.e., printing) is mathematically capped at 21 million coins (at least until a strong enough quantum computer cracks its encryption, perhaps). If a cryptocurrency is centralized or has no max supply, these are massive red flags that suggest it may be what’s called a “shitcoin.”

Shitcoins are scams that often go like this: centralized scammer releases a limited supply of coins, manipulates the price with false claims, and then dumps a ton more shitcoins created out of thin air. Sadly, this is what the Federal Reserve has already done with the US dollar, especially since 1971 when Nixon suspended the gold standard. More recently, after the government mandated Covid shutdowns roiled markets, Jay Powell bragged on “60 Minutes” about how the Fed literally “flooded the system” with dollars for Wall Street. When asked how, he said: “We print it digitally.”

Fed wonks may argue over mechanics, but Powell said what he said. The Fed certainly is not supposed to have the power to print digital money out of thin air. But the Fed seems to think it does. And the Fed has never been audited. And the Fed has purchased TRILLIONS in treasuries and mortgage-backed securities, more than doubling its asset balance sheet to nearly $9 TRILLION in less than 2 years. That’s roughly the GDPs of France, Germany and the UK combined.

Some folks argue that the Fed’s lawless dollar printing is not making its way into the real economy, and they’re partly right. The Fed mostly pumps the money into Wall Street megabanks, which in turn use it to lavish Wall Street employees with the biggest bonuses in history. That money is also being used to subsidize the extravagant lifestyles of the wealthiest Americans through near zero rate loans for new mansions in the Hamptons and new superyachts, sales for which have doubled alongside the Fed’s balance sheet. (When megabanks and rich Americans get near 0% mortgages to speculate on residential real estate, regular Americans simply cannot compete).

And now the Fed wants to create a “central bank digital currency” (CBDC) referred to as Fedcoin, in some pathetic attempt to grab a “halo” effect from Bitcoin. Meanwhile, the Biden administration just signed an executive order encouraging the Fed to develop Fedcoin urgently. Literally, the only new feature of Fedcoin is more centralized control and tracking of the existing digital dollar. This is the exact opposite of the original intent of Bitcoin to provide decentralized and trustless transactions that are relatively anonymized and cannot be devalued into oblivion. If the Fed is willing to freeze the assets of powerful foreign nations illegally, do you really want to make it even easier for them to turn off your money for any reason?

Fedcoin has no max supply, no privacy, and cannot be trusted. Fedcoin isn’t just another shitcoin. Fedcoin will be the shittiest shitcoin in history — one shitcoin to rule them all.

But surely Americans see the Fed’s scam for what it is, right? Sadly, no. Most Americans don’t have the desire or time to follow the inner workings of the Fed as long as they’re able to provide for themselves or their families. They’re too tired, distracted or uninformed to pay attention to what the Fed is really doing. That is unless inflation spirals out of control and destroys their standard of living, which is happening now.

Over the years, the Fed has become a master of manipulation and propaganda. And they use brazen lies about inflation that corporate media spews out for them. The goal is to keep the public in the dark for as long as possible while they funnel as much of America’s wealth to Wall Street and the ultrarich as possible.

And now the Fed is controlled by Wall Street puppets whose hubris and greed has exposed the game. The people are waking up to the corruption - and inflation. Regular Americans are not as stupid as the Fed thinks. When they see the prices at the gas pump, in the grocery stores, and in housing poorly correlate to reported inflation rates, they know that something is not right.

Gammon is right: CPI Is the Biggest Scam in US History

The most important tool in the Fed’s propaganda arsenal is what’s called the Consumer Price Index (CPI). Most people hear of it because every corporate media outlet reports CPI as if it’s the infallible, Gospel truth on America’s inflation rate. That’s utter bullshit and here’s why.

The Bureau of Labor Statistics (BLS) and its army of more than 1,000 economists and statisticians intentionally suppress government reported inflation data and have done so for decades. Most of the financial community goes along with the scam because it helps justify the Fed’s ultra-accommodative (i.e., corrupt and reckless) monetary policy that inflates asset prices that mainly benefit the wealthy plutocrats of America (and the world). But there a few brave souls who don’t fall in line.

Goldbugs have been critical of CPI for years. For example, as Peter Schiff highlights in his article “CPI is a lie,” BLS constantly alters its methodology and even admitted to “sweeping” changes to the CPI in 1998. These changes make it impossible to compare current CPI rates to historic averages (e.g. when inflation raged out of control in the 1970s). So when you hear we have the “worst inflation rate in 40 years” but at least it’s not as bad as the 70s, this is an intentional lie. It’s easily as bad or worse when using prior methodology.

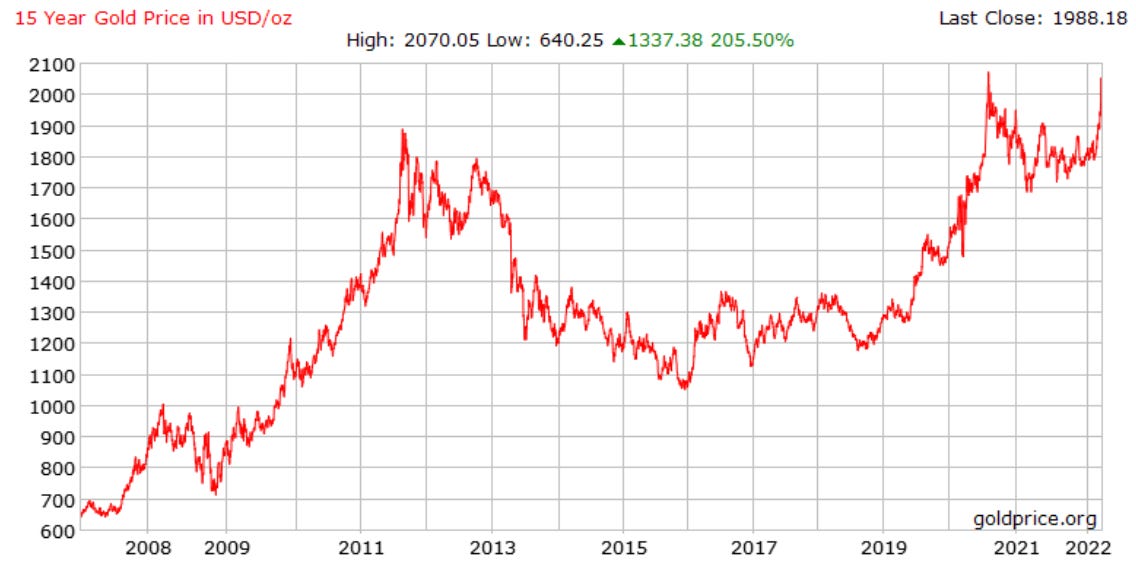

But some critics say gold and precious metals investors have a vested interest in making the public think there’s more inflation than there is. Because that scares people into buying up precious metals as a hedge against dollar debasement. These folks will try to gaslight you by, for example, showing that the price of gold and other PMs have not appreciated considerably against the dollar since the Great Financial Crisis. If inflation was out of control, why isn’t the price of gold skyrocketing?

Of course, they don’t mention that Wall Street has been artificially manipulating down the price of precious metals markets since the GFC too. For example, JP Morgan was caught read handed by the SEC doing this very thing through illegal spoofing trades. They were fined less than $1 billion, which is truly a slap on the wrist for the largest megabank in the world.

And of course, the public has decided to invest in what they view as another inflationary hedge against out-of-control central bankers — bitcoin/cryptocurrency. That’s why financial advisers like Lawrence Lepard encourage investors to diversify into both gold/silver and bitcoin.

The Heart of the #CPLie is Housing Inflation

Ok, we know what you’re thinking at this point. Occupy The Feders are tinfoil hatters. Sure, the BLS manipulate their methodology, but stats are always imperfect.

CPI isn’t just a little off, friends. And it’s not just goldbugs who are calling foul — it’s a growing contingent of well-respected investment advisers and housing industry experts. The biggest expense ordinary folks have is keeping a roof over their heads. And that’s where the CPI manipulation is most insidious.

Michael Liebowitz, CFA served as a mortgage trader and then senior director over 15 years at government-subsidized Federal National Mortgage Association (commonly known as Fannie Mae). He then became a private investment adviser and provides some of the best free analysis out there via RIA. We encourage everyone to read his article: “BLS’ Housing Inflation Measure Is Hypothetical Bull****[shit].”

Two other great resources are Mish Shedlock who runs mishtalk.com (see e.g. “The CPI Measures Inflation And Other Widely Believe Economic Nonsense,” “Every Measure of Real Interest Rates Shows The Fed Is Out Of Control” and “Home Price Growth Accelerates”) and George Gammon (his 20-minute video on how CPI is “The Biggest Scam In US History” provides some great insights, though we don’t agree with everything he suggests about the Fed).

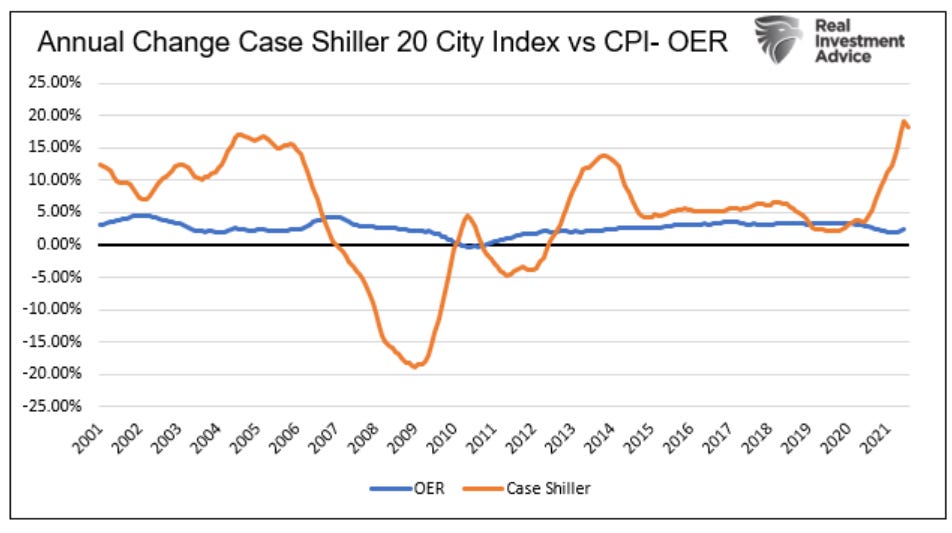

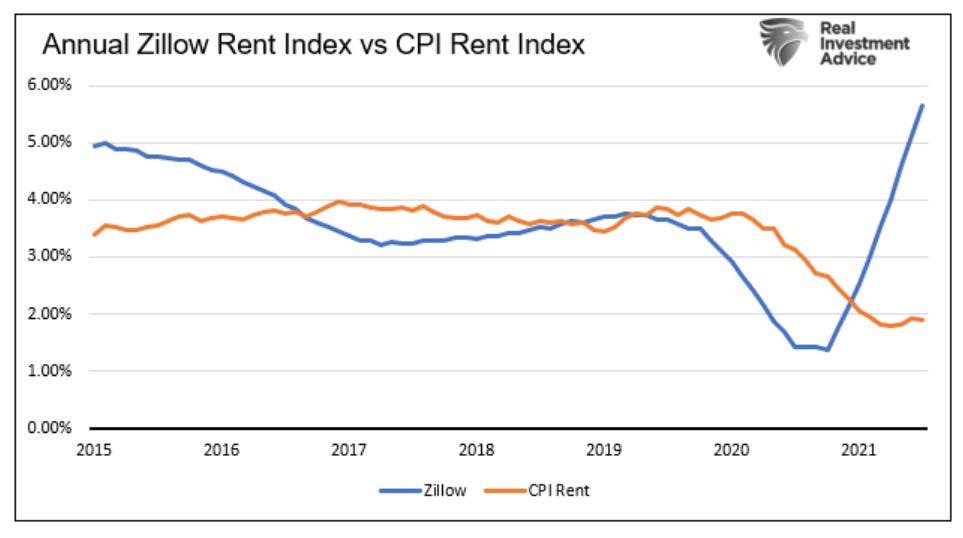

The crux of the problem is the Fed uses something called Owner Equivalent Rent (OER) to manipulate, by far, the largest weighted component of CPI. As Mish explains, OER is “the mythical price BLS says one would pay to rent one's own house from oneself, unfurnished, without utilities” — and it is “the single largest component in the CPI with a current weight of 24.251% of the total CPI.” The BLS stubbornly refuses to use housing inflation because houses are supposedly just investments. OER is an insanely ridiculous representation of shelter inflation.

The BLS also uses a purported rent index that comprises about 7% of CPI. Again, it’s a total joke that is nothing like reality. Does anyone in their right mind think rental inflation WENT DOWN and was anywhere near 2% or 3% in 2021? If the financial industry (which owns corporate media) didn’t have a vested interest in misreporting inflation, the BLS would be a fucking laughingstock.

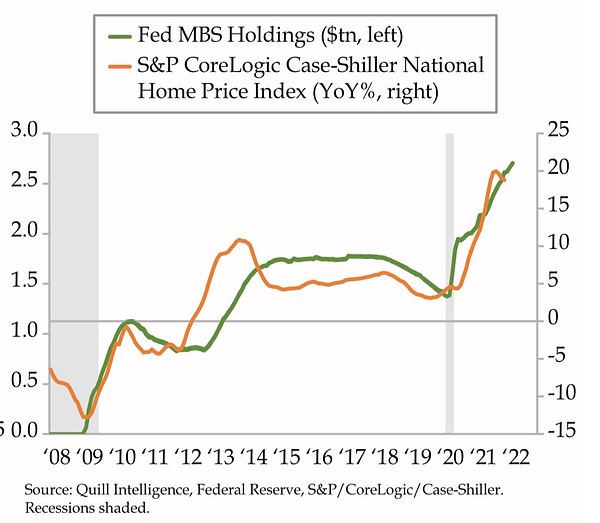

But why would the Fed want BLS to so drastically underreport housing inflation? Because they’re the ones intentionally causing it with $2.7 TRILLION in mortgage-backed securities purchases. The Fed effectively owns a quarter of all US mortgages.

WTF?! This is un-American. This is not capitalism. And it must be stopped.

And as we’ve covered before, megabanks like BlackRock plowed into residential housing in order to front the Fed’s incessant MBS purchases. Why? Because the commercial real estate they already dominated was hammered by the government Covid shutdowns. But Wall Street investors make horrible neighbors. When the housing bubble bursts — and it will — Wall Street will leave the houses in disrepair, vacant on the books or dump them for a loss. We’ve seen it all before in the GFC.

The Fed’s “Transitory” Lie Was All About Suppressing Americans’ Long-Term Inflation Expectations While They Pump Money Into Wall Street

So how does the Fed justify all this? Back in Spring 2021, Jay Powell introduced the idea of “transitory” inflation and hammered on it shamelessly for months until it became too embarrassing. (Expert economist Dr. Mohamed El Erian said by Dec. 2021: “The characterization of inflation as transitory — it's probably the worst inflation call in the history of the Federal Reserve.”). The Fed needed to blame the inflation they were causing on something else.

So they went back to the crisis playbook and blamed inflation entirely on “supply shocks” or disruptions in the supply chain due to the Covid pandemic. And now that the pandemic excuse has worn thin, the Fed and Biden administration blame Russia. Of course, supply chain disruptions from the pandemic or Russia are only responsible for a fraction of inflation. The Fed is FAR more culpable.

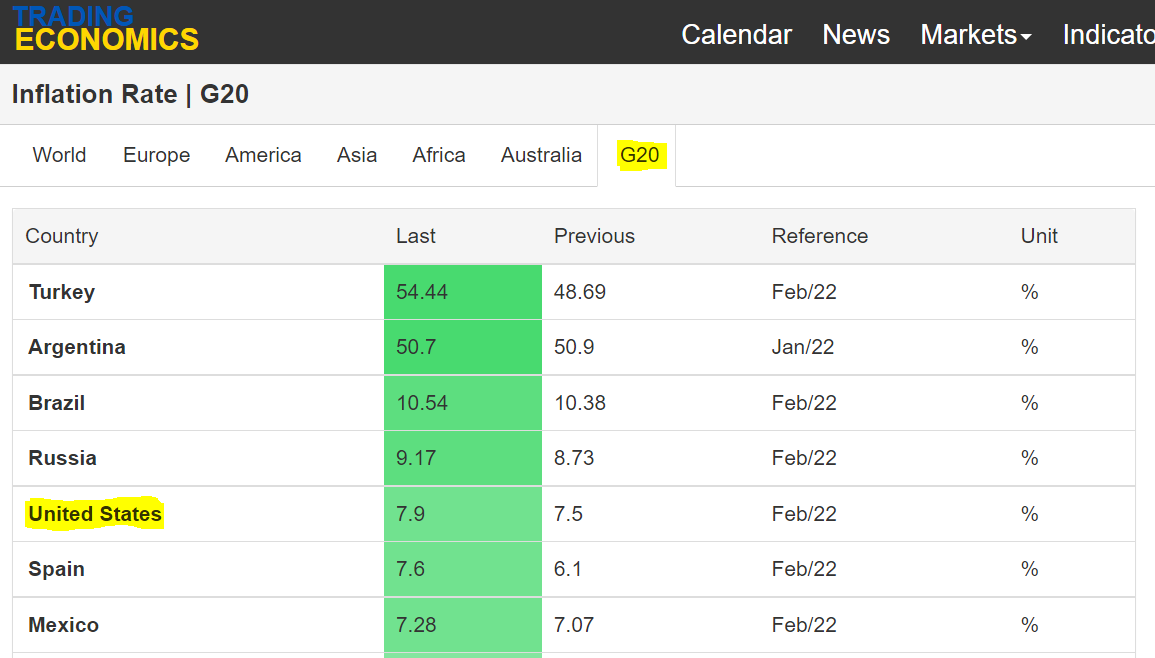

How do we know? Plenty of other countries have to deal with the same global supply chain. But even the Fed’s bogus CPI puts the United States in the top 5 worst inflation of any G20 country after Turkey, Argentina, Brazil and Russia! (Not good company).

The Fed thought it could get away with its corrupt and reckless monetary policy without causing hyperinflation and the collapse of the dollar for two reasons. First, since WWII, the US dollar has enjoyed world reserve currency status. Other countries have relied on the availability and stability of the dollar to trade hard-earned goods and services. And all the US had to do was keep printing it. Of course, Powell just admitted in testimony before Congress that USD’s reserve currency status is in doubt (“It is possible to have more than one reserve currency”). Second, the Fed believes its propaganda has brainwashed enough American to “moor” or “anchor” Americans’ long term inflation expectations to its supposed price stability target of 2% inflation — even if their short-term inflation expectations are skyrocketing.

Powell’s “transitory” lie was key to that. Most inflation expectations surveys come from the Fed, so they’re not exactly credible. But you can see exactly where Americans started believing Powell’s transitory bullshit even on the Fed’s surveys. For example, the NY Fed’s 1-year and 3-year consumer inflation expectations always tracked each other closely until the “transitory” lie. Then they diverged wildly.

The NY Fed has started to crow about how inflation expectations are starting to decline. We highly doubt the accuracy of the NY Fed’s survey results. The more comprehensive University of Michigan surveys show no such trend and are blowing out new historic highs to the highest levels since 1981 (Consumer sentiment is, of course, plumbing new lows too as the Fed continues to destroy the real economy).

In fact, the geniuses at the NY Fed have been carefully analyzing just how much they can get away with lying to the public about inflation. They recently released a lengthy staff report on it here. The TL;DR summary is the Fed maintains a delusional belief that inflationary shocks won’t have a big impact on long term inflation expectations. But they are starting to realize there is now a “relatively larger risk of un-anchoring to the upside” and that “this risk may increase should the high inflation experienced in the spring-summer of 2021 remain elevated for an extended period of time.”

So the Fed is about to reign things in with a piddling 25 bps rate hike, right? It doesn’t matter when the Fed has no credibility to go further. Wall Street is still way too overleveraged. Wall Street is still making horrible, risky bets on explosive derivatives. The Federal Reserve hasn’t even reversed its emergency decision to convert our financial system to zero reserve banking back in March 2020!

And what happens when it all crashes? Just remember it didn’t have to be this way. It’s mostly the Fed’s fault because all Powell and the Fed want to do is continue to enrich themselves and their Wall Street cronies with obscene amounts of wealth.

Well, now you know the Fed’s big inflation scam if you didn’t already. But what good does that do? Knowledge is power. Imagine if every respondent to the Fed and Michigan inflation expectation surveys understood the Fed’s scam too. Inflation expectations would skyrocket, and the Fed would be exposed as the true frauds who destroyed America’s price stability — their primary mandate from Congress.

So let’s get the word out and expose “Fedcoin” for the shitcoin scam it is. Explain the #CPlie to everyone you know in person and over social media. Take physical custody of precious metals and cryptocurrency. Move your cash to a local bank or credit union. Here are ten other great steps you can take from Wall Street on Parade.

As the great Stephen Marley sings:

“Propaganda and lies, is a plague in our lives

How much more victimized, before we realize

It's [Fed] mind control, mind control

Corruption of your thoughts, destruction of your soul

The truth is there for us to see.”

#OccupyTheFed