QE Math Does Not Add Up: Fed Still Secretly Pumping for the Wall Street Banks That Own It?

Occupy The Fed uncovers multi-billion dollar discrepancy between NY Fed's MBS 'principal reinvestment' purchases and staff estimates

At a mostly overlooked speech at NYU’s Stern Business School earlier this month, New York Fed Executive Vice President Lorie Logan gave a rare peek behind the Wizard of Oz curtain shrouding the Fed’s massive quantitative easing (QE) program. Before overseeing the Fed’s “System Open Market Account” (SOMA), Logan was a political science major with no apparent financial training. She managed to rise the ranks by spending her entire 22-year career at the NY Fed. And they trust her to handle their most clandestine and controversial operation.

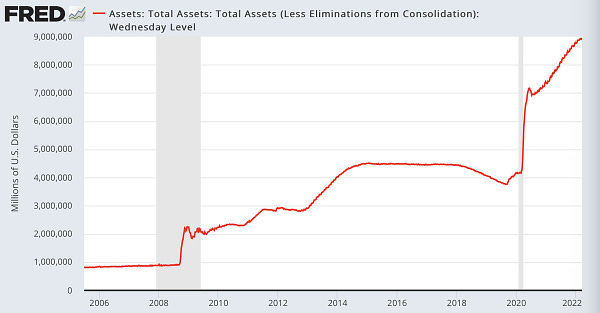

Indeed, Logan has managed the purchase of more than $4.5 Trillion US Treasuries (USTs) and mortgage-backed securities (MBS) — more than doubling the Fed’s balance sheet to $9 Trillion — in just 2 years. The Fed relied on the NY Fed trading desk, and its sole agent BlackRock, to implement our country’s massive, unchecked spending spree on Wall Street paper. Despite the fact that Fed Chair Jerome Powell owns millions in proprietary securities from BlackRock, the shadow banking, private equity giant was selected in a no-bid process that even Wall Street insiders considered “truly outrageous” given the “100-200 other managers who could do this.”

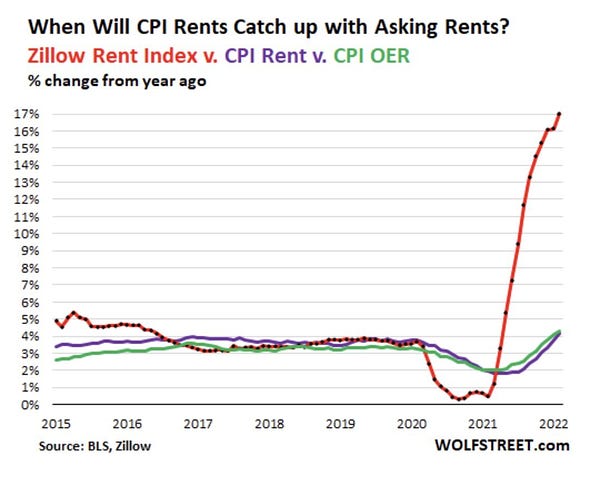

In her recent speech, Logan sheepishly admitted: “In light of recent strength in the labor market and elevated inflation, the Federal Open Market Committee (FOMC) has decided to end net purchases of Treasuries and agency mortgage-backed securities in early March.” By “elevated” inflation, she means the worst inflation in more than 40 years (likely far longer when adjusting for CPI methodology changes). But the Fed is serious about fighting rampant inflation (the Fed caused) because they’re finally stopping their insane, autopilot QE purchases, right?

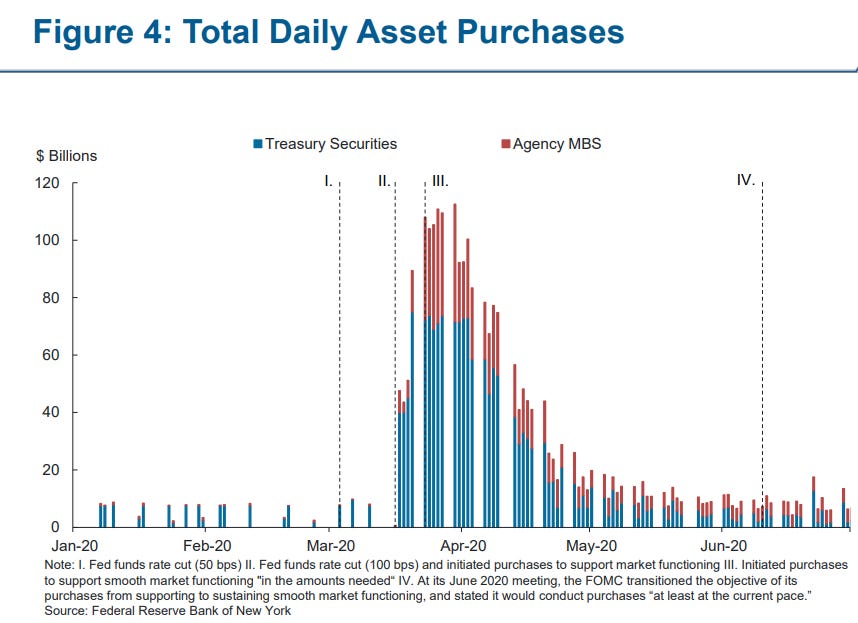

Not so fast. The Fed gets back large returns on its trillions in UST and MBS assets. And the Fed, in its infinite wisdom, believes it’s appropriate to plow those returns on investment straight back into the UST and MBS markets — further fueling the country’s out-of-control inflation crisis. The process for this is incredibly opaque, and we’re just supposed to trust the Fed and no-bid BlackRock aren’t fudging the numbers for Wall Street’s advantage.

Well, the much-ballyhooed end of QE supposedly finally arrived last week. Fed Chair Pro Tempore Powell has repeatedly suggested the Fed’s “taper” and now end of QE shows how serious the Fed is about fighting inflation. And the Fed apparently made its last fresh QE purchase of USTs on March 9.

Moreover, this week the FOMC finally announced it was increasing the Effective Federal Funds Rate (for interest free loans to Wall Street megabanks) from zero to 0.25% or 25 basis points. St. Louis Fed Pres. Bullard went on the record with a rare dissent from his corrupt and feckless colleagues, calling for a 50 bps hike due to out-of-control Fed-fueled inflation. His clarion calls to other supposed “hawks” on the FOMC go unanswered.

Equities markets have proved shaky since the start of the Ukraine war, and justifiably so in light of the risks and sanctions involved. And given the end of QE and rate hike liftoff, some commentators predicted stocks were set to decline further. Instead, stocks just had their best week since November 2020.

So how did the stock market defy gravity this past week?

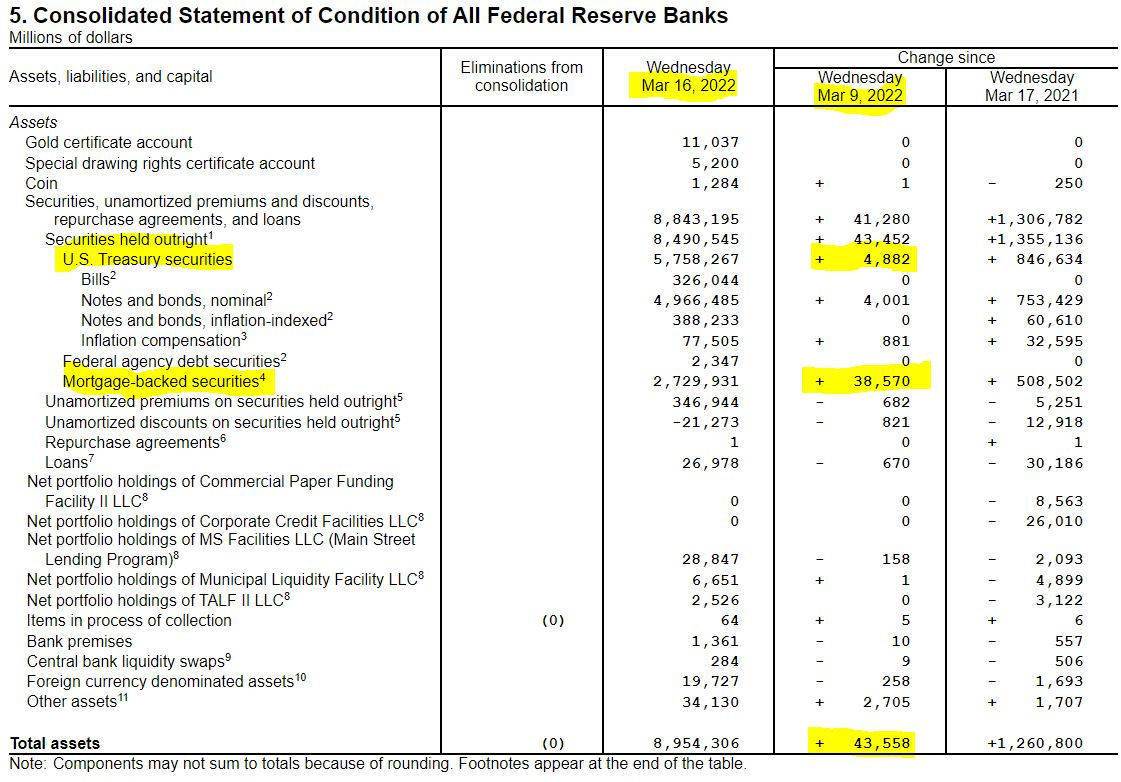

Well, for one thing, the Fed’s balance sheet just carved out NEW ALL-TIME HIGHS to $8.95 TRILLION — increasing $43 Billion in assets in the past week alone. The major contributing factor was $38.5 BILLION in additional MBS holdings. But WTF?! The Fed said QE was over!

Surely, the NY Fed, as directed by the FOMC, was only “reinvest[ing] all principal payments” from the Fed’s MBS holdings, right? It couldn’t possibly be buying additional MBS into out-of-control housing inflation, could it? We wish we could tell you we had any faith that was the case.

Our research suggests the NY Fed, which is literally controlled by 5 of the biggest Wall Street megabanks and whose President is part of the Fed’s Communist-sounding “Troika” with a permanent seat on the FOMC, may be conducting additional QE in the form of billions of dollars of unauthorized MBS purchases.

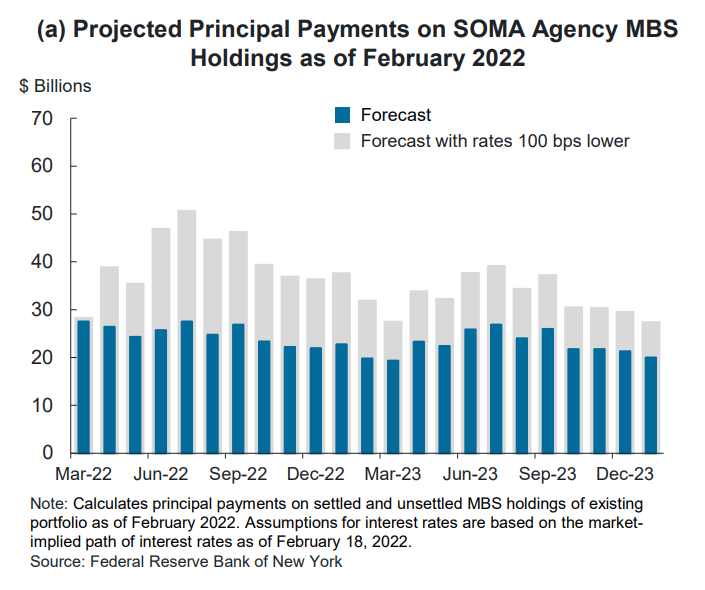

During Logan’s speech earlier this month, she provided rarely disclosed estimates for projected principal payments on the Fed’s MBS holdings as follows:

Logan estimated what looks like roughly $28 Billion in MBS principal payments for the month of March. As she noted, lower mortgage rates mean higher principal repayments, and vice versa. Mortgage rates have been rocketing up and just topped 4% in the US last week (at least for plebians who don’t get below market rates). So principal payments certainly should not exceed the figures set forth above in blue.

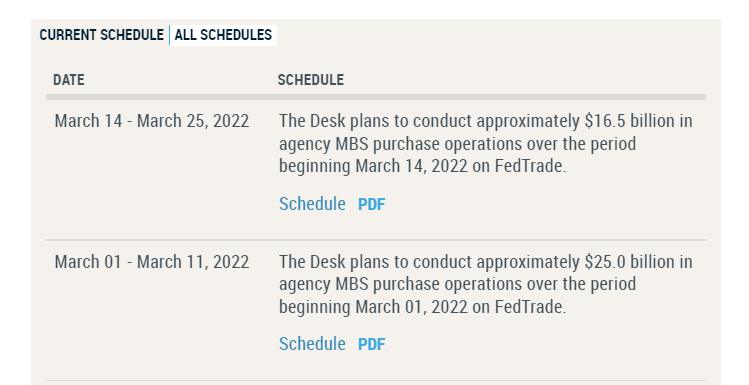

Nevertheless, the NY Fed scheduled $41.5 Billion in MBS purchases from March 1 - March 25 alone (with at least 4 more business days in March). As we noted, Fed MBS holdings increased $38.5 Billion between March 9-16 alone (see below on the Fed’s own balance sheet). Even if the Fed backloaded the entire $10 Billion of the Fed’s last QE MBS purchases (allotted for Feb. 14-March 11), which is unlikely based on the transaction detail, the math simply does not add up.

Basic arithmetic suggests the NY Fed is spending BILLIONS more on MBS purchases than should be theoretically possible if they are really just “reinvesting” MBS principal payments.

Listen, maybe the Fed has some contrived explanation about the timing of securities rolling over or other such nonsense. If corporate media ever actually did their job and asked tough questions, we’d love to hear Powell’s feeble excuses. The Fed clearly owes the American public far more transparency on all this.

Yet, the Fed has zero credibility or accountability. Chair Powell is about to get rewarded with 4 more years after overseeing and being directly involved in a Fed-wide insider trading scandal. And after his Fed has blown its price stability mandate from Congress (long set at 2% CPI) by about 400%. And now after his Fed continues to INCREASE its balance sheet despite the purported end of QE. And after Powell swore before Congress that the balance sheet runoff would come “sooner and faster” than before during his confirmation hearing.

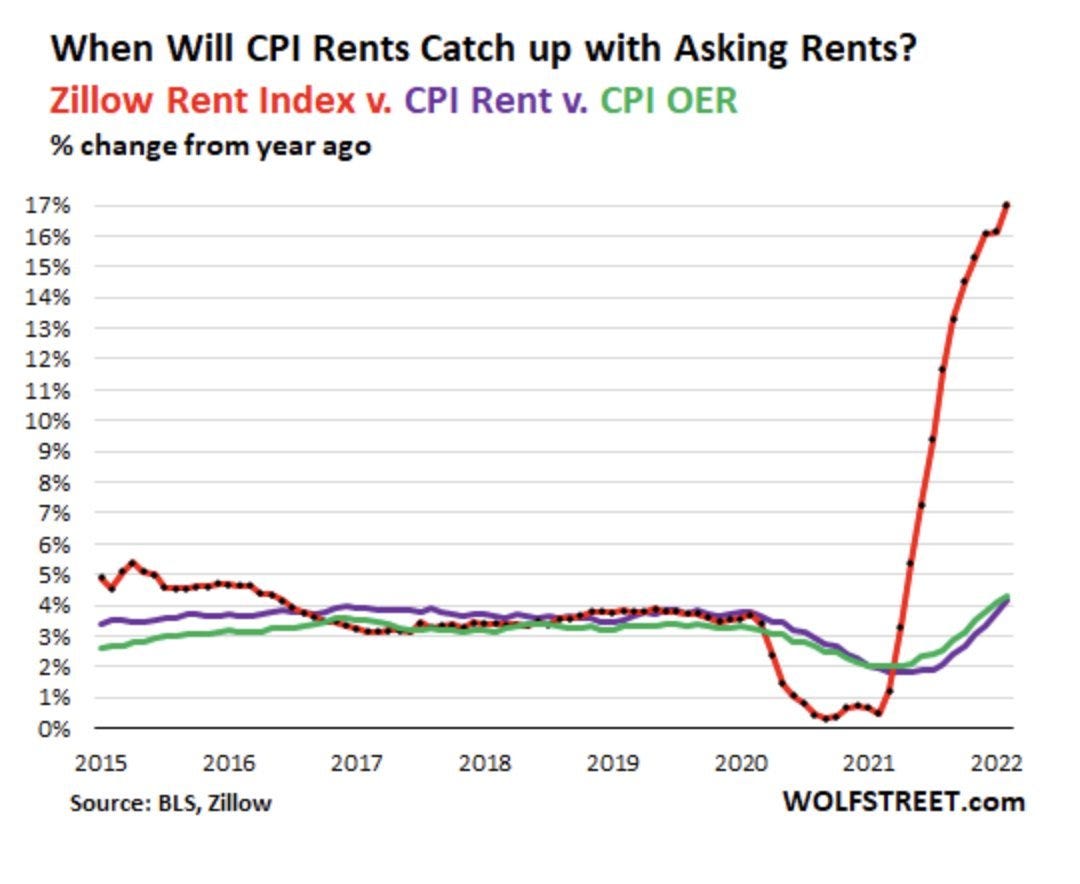

The fact of the matter is that the Fed’s continued reinvestment of principal payments on its $2.7 Trillion in MBS holdings is simply BATSHIT INSANE. The Fed should not be purchasing ANY MBS AT ALL with housing inflation where it is. If there are principal payments, then the Fed should hand any profits over to the Treasury as required and SHRINK their monstrous balance sheet.

Congress should immediately bar the Federal Reserve from: (i) increasing its balance sheet a cent further or (ii) reinvesting any further principal in MBS. The Fed has failed its price stability mandate and shown it is incapable of handling the inflation crisis independently. The Fed must be stopped — unless perhaps Congress and the Fed actually WANT the US to have a full-fledged national homelessness crisis?

Finally, we DO NOT want to give anyone the false impression that the Fed is still pumping stock and housing markets at the same insane rate it has been under the guise of pandemic response. That is exactly what Wall Street (and its controlled opposition) wants you to think — that houses and stocks will always go up in price because of the Fed. No, the Street just wants to extend its runway to dump toxic debt and securities on retail bagholders before the next crash.

Wall Street is still massively overleveraged. It still has untold exposure to more than a quadrillion dollars in shadowy derivatives overhanging the entire financial system. None of that has been unwound. The Fed hasn’t even reversed its radical “emergency” decision to allow zero reserve requirements for banks.

But the Fed’s lies have worn thin. They’ve been trapped into rate liftoff by skyrocketing inflation. And the FOMC March Implementation Note notably deleted this long-standing directive: “Increase holdings of Treasury securities and agency MBS by additional amounts as needed to sustain smooth functioning of markets for these securities.”

The Fed-Wall Street house of cards cannot stand on its own without perpetual, unsanctioned Fed bailouts. Why? Because you can’t taper a Ponzi. And everyone on the Street knows damn well the Fed can’t hike 6-7 times before things fall apart. They’re simply banking on getting even more bailouts whenever markets buckle — just like the $20 TRILLION in repo loan bailouts the Fed “broke the law” to hand out to Wall Street in fall 2019 before the Covid pandemic even hit.

We hope our articles prove informative. Everyone who is gambling their hard-earned money on the Fed’s everything bubble needs to pay close attention to what the Fed is doing — not just what it’s saying. The Fed constantly lies to the public about what it plans to do (while leaking policy moves to Wall Street in advance as evidenced in a big data study of 500 million NY taxicab rides). Sadly, this is what our centrally planned Soviet-like “markets” have come to (we’ve even heard some folks who resort to investing based on what color tie Powell is wearing).

Calling all data analysts and accountants to the movement. We need to drill down harder on Fed data now more than ever. The pandemic “emergency” is long over, but Fed corruption is still out of control. Corporate media is owned by Wall Street and refuses to report on any of this. If we don’t catch the Fed out on its propaganda, lies and stealth Wall Street handouts, then no one will.

-#OccupyTheFed

*It should go without saying that everything Occupy The Fed writes is for informational purposes only and represents the writers’ opinions based on publicly available information. Nothing we write is ever intended as, nor should it be relied upon as, investment advice. The best investment advice in this Golden Age of Fraud seems to be based on inside information from government officials, so who are we to compete with that.

You are writing on the most important issue facing America today. The effect it has on our citizens and people all over the world cannot be understated. Please god, give the substack traction, so that more people open their eyes.