The Great Fed Ponzi Taper Trick: What Happens When the 'Magic' Stops?

FED frontloads more than $140BN USTs and nearly $30BN MBS purchases in first 3 weeks of May, but equity indices still down around 20% before massive QE cliff in June

A great magician never reveals his tricks. Fed Chair Powell isn’t a great magician, and his dirty tricks are becoming painfully obvious. He levitated Wall Street and the 1% with tens of trillions in illicit repo bailouts, then slashed reserve requirements and interest rates for banks to zero, while doubling the Fed balance sheet with trillions in “Quantitative Easing” assets purchases.

Same old Fed tricks, just far bigger, more reckless, and more brazen. The only reason the Fed hasn’t been lambasted more: corporate media is now fully owned and controlled by Wall Street. But the Great Powellini let his magic show go too long, and the crowd is restless. #CPLie reports inflation has been 5%+ for more than year with back-to-back 8%+ prints the past two months. Real inflation is at least double reported figures. The Fed is now caught in a vice of its own making.

Powell is still claiming he can pull a rabbit out of a hat and achieve a “softish” landing after blowing the biggest “everything bubble” in human history. He’s only making things worse and prolonging the pain. At a recent staged press conference, a reporter asked Powell why the Fed is waiting until June to start “Quantitative Tightening” with inflation spiraling out of control. Powell retorted: “It was just — pick a date. That happened to be the date that we picked. It was…it was nothing magic about it.”

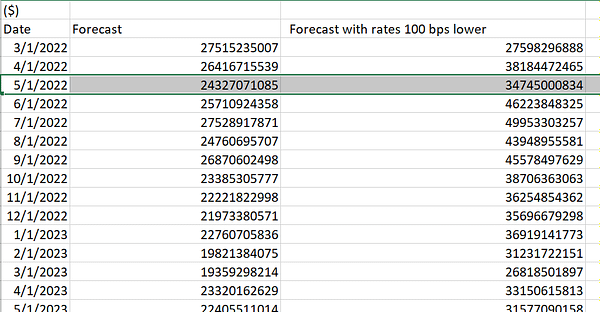

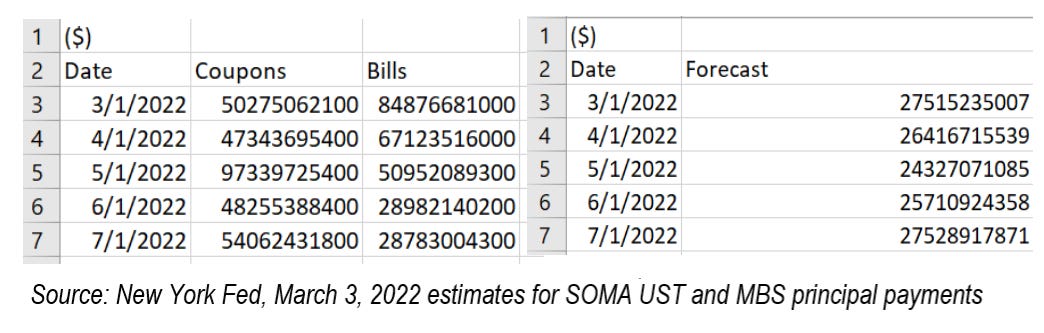

Bullshit. The Fed also happened to estimate more than $170 Billion in principal payments coming due in May. And Powell wanted yet another month of massive Fed purchases on the books without any pesky caps getting in the way.

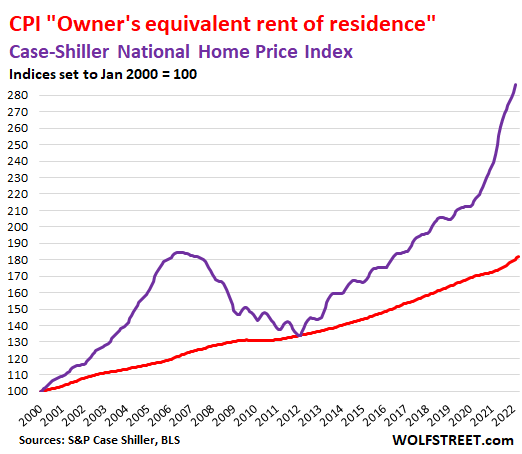

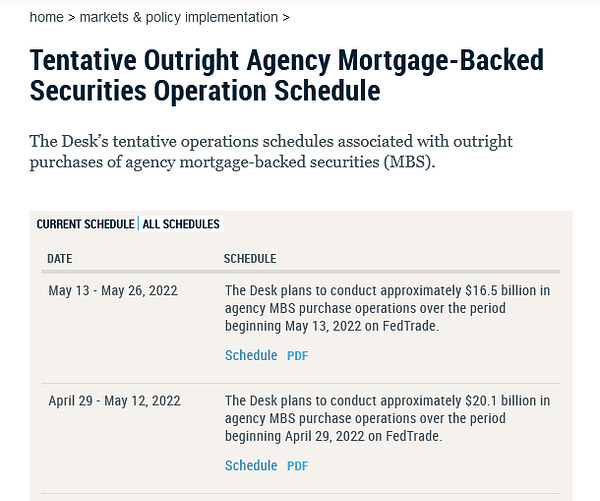

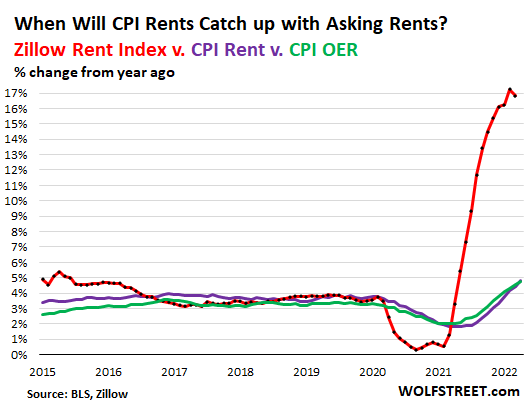

To date, the Fed has done almost NOTHING to fight raging inflation. They’ve raised the Fed Funds Rate a piddling 0.75% from zero. They haven’t done a thing to shrink their monstrous $9 trillion balance sheet — a key driver of inflation. And they weren’t going to let a national inflation crisis get in the way of “reinvesting” more than $170 Billion and counting in US Treasuries (USTs) and mortgage-backed securities (MBS) to try to juice the stock market.

Spoiler alert: Powell’s ploy has failed so far because even an enormous sum of $170 Billion in a month isn’t enough to cover the size of the Ponzi scheme the Fed has pulled on America. As Occupy The Fed first exposed, since the supposed end of QE in March, the Fed has repeatedly bought tens of billions more MBS than their own MBS principal estimates. And they are still doing it in May despite truly astronomical housing inflation. It’s unconscionable and indefensible.

And what about US Treasuries? It may end up worse. The Fed already bought more than $140 Billion in USTs in the first 3 weeks of May alone! (Feel free to check our math: https://www.treasurydirect.gov/instit/annceresult/press/press.htm). If the Fed actually sticks to just “reinvesting” principal, they have only ~$8BN left to spend over the next 10 Treasury auctions scheduled for May! Well, that doesn’t bode well for interest rates.

But does anyone doubt Powell’s Fed will buy way more USTs than their actual principal payments in a desperate and deceitful attempt to keep rates from exploding way higher? This despite $150BN in principal payments to reinvest for May! This despite already frontloading more than $140BN of those sums to artificially depress rates, prop up the stock market, and make inflation worse.

Of course, the big problem for the Fed is that the rubber meets the road in June. Powell finally “picked a date” to start his grand plan to shrink the Fed balance sheet with small phased-in caps ($30 Billion for USTs and $17.5 Billion for MBS for the next 3 months). But what some may not realize: principal payments for USTs are estimated to drop off sharply in June and July (~$80BN from nearly $150BN) and around the same or lower for MBS (~$25BN). Of course, the new caps starting June will make things feel even steeper. And after the summer, the larger caps will arrive ($60BN cap on USTs and $35BN cap on MBS).

So what happens when you try to taper the biggest Ponzi scheme in history? Well, the “smart money” on Wall Street doesn’t want to stick around long to find out. We wouldn’t be surprised if the Fed and their cronies try to manipulate a bear market rally or two to trick retail into thinking the Fed is still working some magic. But the Street knows you can’t taper a Ponzi.

And the last people left in a Ponzi (i.e., retail investors) get stuck holding the bag…

#OccupyTheFed

*Everything Occupy The Fed writes is for informational purposes only and represents the writers’ opinions based on publicly available information. Nothing we write is ever intended as, nor should it be relied upon as, investment advice. The best investment advice in this Golden Age of Fraud seems to be based on inside information from government officials, and we would never try to compete with that.

Super job as usual. One small disagreement. “the biggest “everything bubble” in human history. “. I think that is true in today’s $ terms but not (yet) in % terms. Japan did something similar to Powell. The Ponzi scheme ended in about 1990. I recall at one point the Japanese stock market was larger than the U.S. stock market. What followed was “the lost decade.” In reality, more like “the lost three decades.” This is what we have to look forward to thanks to JPOW. Although he still appears to have some chance to partially redeem himself by cutting the Fed balance sheet to close to $1T and raising the Fed rate to 4% (minimal “normal” numbers). But the clock is ticking on his chance to do that. As your article reveals, so far in May he’s been doing the opposite with purchases of outrageous amounts of Treasuries and MBS. No doubt intended to hold the 10 year treasury under 3% so as to prop up the stock market. That’s not JPOW’s job nor should it be.

JPOW and the user. Lesson not learned: Don’t mess with Mother Nature (the human body) and don’t mess with the Invisible Hand (economy). Artificial interference messes up the works, especially a stimulant that produces a temporary high and becomes addictive.