What Taper? Fed buys $101.3 Billion USTs and $35.5 Billion MBS during month of April alone

Fed pushes inflation higher with stealth asset purchases despite purported end of QE; stocks pull back despite key Fed interest rate still at fraction of a percent

May Day, May Day. U.S. stocks indices pulled back a few percent on Friday. The bull market thesis suffered some real technical damage. But for all the doom and gloom, does this really feel like “total capitulation” to you, as some permabulls suggest?

The problem for bulls: the Fed still hasn’t actually done anything yet. The Effective Fed Funds Rate is still effectively zero (0.33% is nothing with inflation raging at roughly 20% in the real world). The Fed has merely jawboned about rates and threatened a piddling 0.5% hike this week (whoop-dee-doo!). Look what happens when Fed officials can’t give speeches laced with spineless flip-flopping to coddle the stock market during the FOMC communications blackout.

The Fed (aka the “Lords of Easy Money”) has addicted our entire financial system to easy money with endless ZIRP and QE. Without it, things fall apart fast. And the Fed is still secretly pushing drugs like there’s no tomorrow, just like it purchased $120+ Billion in US Treasuries and mortgage-backed securities (MBS) every single month on auto-pilot for years. But Jay Powell announced the Fed’s controversial ‘Quantitative Easing’ asset purchase program would end in mid-March. April was the first full month after the supposed end of QE.

Guess what? The Fed is still an out-of-control heroin dealer for Wall Street. During April alone, the Fed purchased more than $95 Billion in US Treasuries and more than $35 Billion in mortgage-backed securities, for a combined $130+ Billion in asset purchases. But Powell would surely tell you it’s “not QE” anymore.

In terms of Treasuries purchases, the only difference is the Fed is buying at auction. But they’re still the 800-lb gorilla in the market, artificially depressing rates and monetizing massive amounts of debt. The Fed’s latest purchases are particularly focused on short-term T-notes, in some pathetic and transparent attempt to artificially control and unkink the yield curve.

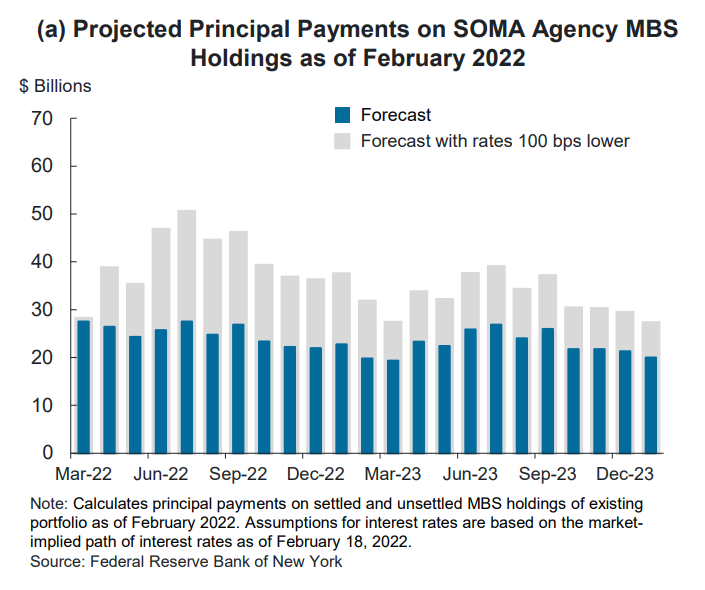

In terms of MBS, as we explained for March, the Fed continues to purchase substantially more MBS than their own recent estimates of principal repayments for MBS already on the balance sheet. The Fed bought more than $35 Billion MBS in April alone, and they plan to keep buying at a rate of about $2 Billion per business day in May. This casts serious doubt on whether these are “mere reinvestments” of principal as the Fed and its apologists assert or whether the Fed and BlackRock are dishonestly buying even more MBS to keep housing prices artificially propped higher. The Fed’s own estimated principal payments for April were less than $30 Billion!

Note also that grey portions of the forecast above clearly should not come into play right now. There is no question that MBS values and principal payments significantly decrease as mortgage rates rise, which they have as average mortgage rates skyrocket above 5%. Thus, prepayments to the Fed should, in fact, be less than even its blue forecasted figures above. So where is the Fed’s additional investment in MBS coming from? No one has provided a detailed, plausible answer to date.

So, the Fed continues to purchase massive amounts of assets into soaring inflation. And perhaps most importantly, the Fed has caused a protracted nationwide housing affordability crisis. More than even gas and food, folks are struggling just to keep roofs over their heads. And even mainstream media like CNN has to admit that, with rents rising another 20% year over year, inflation is putting regular Americans “out on the street.” Of course, they’ll never tell you the real cause of all this — the Fed (which relies on the CPI reporting less than a quarter of actual housing inflation to obfuscate its reckless monetary policy).

The Fed-fueled inflation crisis has also become a major drag on the economy. This week, we learned that GDP contracted a surprising 1.4% in the first quarter. What’s the real problem? The Fed has zombified and financialized every last sector of our economy with more than a decade of ZIRP and QE. There is no real growth. It’s all artificial and requires larger and larger amounts of juice from the Fed to continue, i.e. “you can’t taper a Ponzi.”

But don’t worry, Jay Powell and his friends plan to raise the Fed Funds rate a piddling 0.5% next week. We’re sure that will fix everything right up. No, no — the Fed is in absolutely no rush to fight inflation or normalize our financial system to set our economy up for real, long-term growth. The only time there’s ever a sense of urgency at the Fed is when Wall Street needs tens of trillions of dollars in bailouts.

Why? Because Jay Powell wants to keep massively enriching himself and his cronies at everyone else’s expense and could give a damn about the hardships of American middle & working class families being destroyed by the worst inflation in generations. That’s exactly why we all need to do everything we can to get our elected reps in the Senate to #FireJPow next week.

-#OccupyTheFed

*It should go without saying that everything Occupy The Fed writes is for informational purposes only and represents the writers’ opinions based on publicly available information. Nothing we write is ever intended as, nor should it be relied upon as, investment advice. The best investment advice in this Golden Age of Fraud seems to be based on inside information from government officials, so who are we to compete with that.

Powell said they are not considering a 75 basis point hike. Who asked him to speak after every Fed meeting? Nobody but JPOW himself.

“Total capitulation.” That’s Fed speak for “let’s subsidize the grossly bloated stock market even more at the expense of the 99% suffering from inflation.” 4200 (S&P) is not total capitulation. Nor is 4000. Nor is 3000. The fundamentals (price/earnings, price/revenue, price/book, price/free cash flow) justify a number south of that. And many companies are 5-10X overvalued. (There are some undervalued also in this den of gamblers market.) Buffett and Munger nailed it. As you say, the media blames everything but the Fed for inflation. When the Fed is the primary cause. At a minimum, to start to undo the damage the Fed has done, there should be no rollover of Treasuries and MBS. Let them mature. And normalize the Fed rate. That means north of 4%. Somehow these ideas have come to be viewed as radical when, 15 years ago and for all the years prior, they would be considered normal. And ZIRP and QE were considered radical, if not unthinkable because of the highly inflationary effect.