Rules Don't Apply & "Mistakes" Don't Matter if You're Rich in America's Golden Age of Fraud

Everyone from executives to government officials are apparently above the law

It’s tax day. Did you know the IRS is more likely to audit the poor than the wealthy? Meanwhile, wealthy Americans have largely been free to loot supposed pandemic relief programs for 2 years. The “Paycheck Protection Program” ended up the “biggest fraud in a generation” — it’s certainly not the working class buying Lambos, Teslas, private jets and other toys with ill-gotten PPP funds. But the government would rather hire 80,000 new IRS agents to hassle the working class poor like say, the valets at Jeff Bezos’ DC mansion parties, instead of investigating massive PPP fraud or the dealings of the top 1% who often pay no taxes. Such is the state of our country.

If you’re the President or share the same family name, it seems you can engage in sordid crimes and corruption with impunity these days. It’s an apparent benefit of the highest public office decades after corporate media used to expose the powerful, like with say Watergate. Indeed, the presidency seems to confer the kind of immunity from prosecution once reserved for the monarchy of England, like say Prince Andrew.

But ever since the Global Financial Crisis, the protection has broadened to encompass everyone from rich technocrats to petty bureaucrats. Indeed, the government failed to hold almost any white-collar criminal actually accountable for the GFC. The SEC prefers to target small fry wash traders and pump and dump schemers, while turning a blind eye to rampant market manipulation by the biggest industry players like Citadel.

Forget moral hazard, this is immoral reward. We are literally incentivizing people to lie, cheat and steal their way to the top. And you won’t be punished as long as you make enough, live in the right zip code and have the friends in high places. It’s a total perversion of the American way, a fundamental breach of the social contract. That’s why it should come as no surprise that the Fed engaged in $10s of trillions in illicit megabank bailouts both before and after the Covid pandemic hit. Indeed, the Fed may have even secretly provided a $6.7 Billion bailout for Jeffrey Epstein at one point.

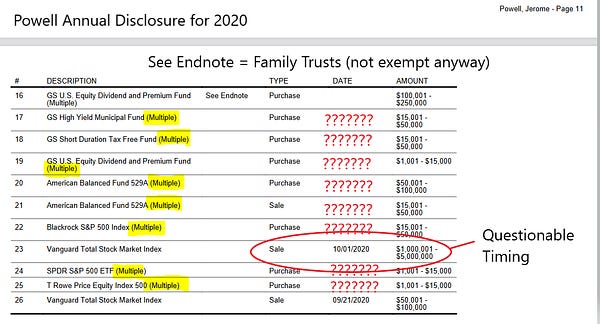

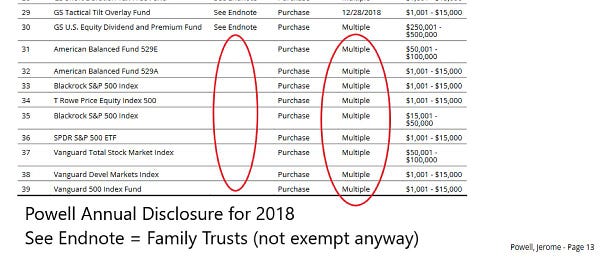

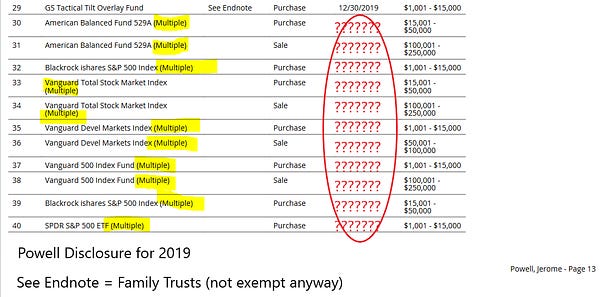

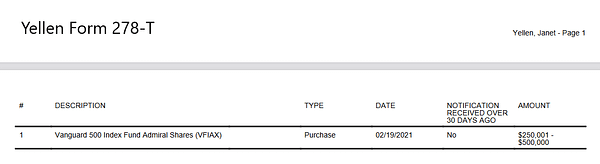

As we broke over two months ago, Acting Fed Chair Powell flagrantly violated stock trading and disclosure rules, including trades during multiple FOMC trade blackouts. There have been zero consequences to date. When questioned by another independent outlet, the Fed suggested Powell’s adviser just made some “mistakes.” As Fed expert DiMartino Booth said, “there’s no such thing as ‘mistakes’ made during Fed blackout, especially for the Chair.” Of course, Powell legally retains responsibility for his own trading and disclosure compliance. Powell’s violations are sprawling, gravely serious, and totally inexcusable. And they may be just the tip of the iceberg.

Powell would also have you believe that the Fed mistakenly stumbled into massive policy error by continuing “emergency accommodation” too long and sparking rampant inflation. When grilled by a member of Senate Banking about why the Fed got it so wrong, Powell suggested most economists didn’t predict persistent inflation. It was just “some voices” that warned against him calling inflation “transitory” while pumping $120 billion plus in QE every month and increasing monetary supply by 40 percent. Bullshit.

A litany of notable and well-credentialed “voices” warned the Fed:

March 2021: Former U.S. Treasury Secretary Larry Summers and former chief economist of the IMF Olivier Blanchard warned that the “American Rescue Plan” could overheat the economy and result in rampant inflation. Summers called the policy the “least responsible” in 40 years. Fed officials pushed back and said there was no “long-term, persistent upward risk to inflation.”

But hey, maybe the Fed thought Mr. Summers’ credibility was too damaged by the crowd he kept. Well, that’s OK, there were many others sounding the alarm.

May 2021: Billionaire investment legend Stanley Druckenmiller penned an Op-Ed in the Wall Street Journal warning that “The Fed is Playing with Fire”:

“With Covid uncertainty receding fast, and several quarters deep into the strongest recovery from any postwar recession, the Federal Reserve’s guidance continues to be the most accommodative on record, by a mile. Keeping emergency settings after the emergency has passed carries bigger risks for the Fed than missing its inflation target by a few decimal points.”

June-August 2021: Economist and former CEO of PIMCO Mohamed El-Erian repeatedly said the Fed was making a policy error by continuing massive stimulus and that “monetary policy is the wrong tool” for improving the economy.

Even Former Fed Presidents not generally known for their dissenting opinions (unlike say, Hoenig) had joined the chorus by Fall 2021:

“Former Richmond Fed Jeffrey Lacker said the Fed is way “out of bounds” in its reaction to this inflation surge.

And former New York Fed President William Dudley said the central bank “is pretty late” in terms of responding to higher prices.”

By December 2021, CNBC’s Steve Liesman incredulously asked Powell at his staged presser: “It’s often said that monetary policy has long and variable lags. How does continuing to buy assets now, even though it’s at a slower pace, address the current inflation problem?” Powell’s answer:

“Markets can be sensitive to [downward adjustments to the balance sheet].” In other words, we care more about stocks (owned mostly by the wealthiest Americans) than how inflation impacts the rest of you.

Suffice it to say, it is hard to believe any of this was a mistake. The Fed doesn’t care about how inflation massively burdens the poor, working and middle classes. The Fed only serves the wealthiest Americans, who have plenty of disposable income to pay for food and gas and are funneled trillions from the Fed to inflate wealth assets to help offset inflation. Indeed, Wall Street just lavished its employees with the biggest bonuses in history. Trust us, they’re not worried about inflation on the Street.

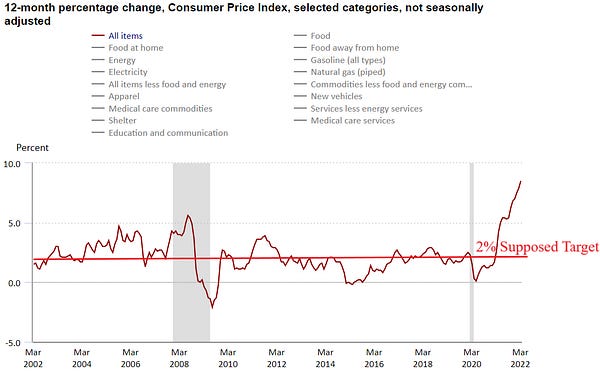

The Fed is supposed to have one primary job — price stability. Powell admitted himself that maximum employment is wholly contingent on the price stability mandate: “Price stability is a precondition for achieving a strong and sustained labor market...you can't have maximum employment for any sustained period without price stability.” Whether you agree that the CPI vastly understates real inflation or not, the one clear metric for price stability is 2% CPI.

Well, guess what? The Fed under Powell has utterly failed its mandate from Congress. The CPI has been over DOUBLE the supposed 2% target for more than a YEAR. Currently, it is more than QUADRUPLE that at 8.5%. This is a whole different ballgame than coming up short by a few decimal points as Stan Druckenmiller warned.

How in the world does the President and the Senate reward such incompetence — and worse — by Powell with another 4 years as Fed Chair? Unless our elected “leaders” on both sides of the aisle don’t care about anyone other than themselves and their wealthy cronies too. Every incumbent — red or blue — who votes to reinstall Powell should lose their jobs in November.

#OccupyTheFed